Investing can involve a lot of work, with the investor having to research stocks, review financial statements, and check out various financial ratios to ensure that the investment is a wise choice. For a Muslim investor, it can involve even more work to make certain that the investment is halal, or Islamically permissible. For example, before buying shares of stock in a company, a Muslim investor has to check if the company’s core business clashes with Islamic principles (i.e. an alcoholic beverage company), and confirm that the company doesn’t have too much leverage (i.e. debt).

There are some of us who want to invest and grow our wealth by putting our money to work, but don’t exactly have the time or desire to do the research required. One option is to hire a financial advisor and pay them a commission to do the work. Yet another option, and one that is growing in popularity, is the use of robo-advisors.

In short, the investor provides the robo-advisor with some information — such as time horizon and aversion to risk — and the automated advisor will then apply algorithms to determine what mix of investments would be suitable for this investor. It will then apply the investor’s funds to that investment mix. The investor won’t have to worry about buying individual stocks or paying a brokerage fee for each trade. The robo-advisor essentially does all the legwork.

Pretty cool concept, huh? Even cooler is that there is now a Muslim robo-advisor called Wahed. As with other robo-advisors, the investor provides information and Wahed will come up with an optimal portfolio of investments. The beauty is that Wahed will automatically filter out certain industries like gambling and alcohol, as well as interest-based investments like conventional bonds.

Depending on your risk assessment, Wahed will allocate your funds accordingly. For example, if you want to take a more conservative and safe approach, the majority of your money will be invested in fixed income investments. This is referring to sukuk, or the Islamic equivalent of a bond. The return on investment won’t be very high for fixed income investments, but they are far less likely to lose value and at least protect against inflation.

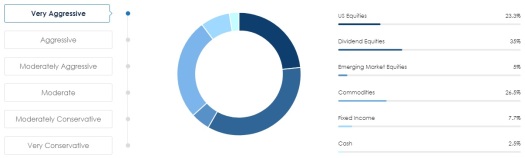

On the other hand, if you are young and want to take a more aggressive approach to investing, more of your money will be invested in equities. This will include stocks for medium and large corporations, plus dividend-paying stocks. A good portion of money may also be allocated to commodities, which refers to metals, agricultural products (i.e. rice, grains), or raw materials. These types of investments are more volatile and will see more price fluctuation, but provide the potential for higher gains.

Of course, using a service like Wahed is not free, but will likely cost an investor less than a human financial advisor. The nice thing is that Wahed “wraps” all fees related to investing (i.e. investment advising, transaction fees for buying/selling) into one fee. If you have less than $50,000 US invested with Wahed, it will charge a management fee of .99% annually, which is in line with the management fees of many mutual funds. There are cheaper robo-advisors, but they are not designed to filter halal investments.

If you have more than $50,000 invested with Wahed, the management fee will decrease, as low as .29% annually. To give you an example, if you invest $1,000 with Wahed and the total value reaches $1,100 by the end of year one, Wahed will take the total asset value of $1,100 and deduct .99% to cover its fees for managing the account. In this case, that would be 1100 * .0099 = $10.89.

If this sounds like a good investment service for you, check out Wahed’s website to register and fill out the assessment form to get started. If you are new to investing and want to learn the basics, check out my Kindle book, The Stock Market Made Simple.